tax return news australia

CALCULATE YOUR REFUND NOW. New research has shown that planned tax cuts would overwhelmingly help men on high incomes while millions.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

ABSTUDY Living Allowance if youre 16 or older.

. Stay up to date with the latest news headlines within the tax industry. Based on current figures which could change in this years budget the LMITO is worth between 255 and 1080 and is paid according to a. The Australian Taxation Office has expressed its concern that some taxpayers do not fully understand the tax implications of cryptocurrency gains.

Interest on early payments and overpayments of tax 2012-13. The good news is you can claim a deduction at tax time but it also comes with an important warning. The upper income threshold for the 325 per cent tax bracket.

7NEWS brings you the latest Tax news from Australia and around the world. Most payments are assessable for income tax purposes. Heres what these Stage 3 tax changes will mean for various income levels.

You can access the MYEFO papers on budgetgovau. The Tax-News brand is owned and operated by Wolters Kluwer BSI Limited. In this day and age most.

This is down from 207 billion claimed by. Simply enter your numbers and our tax calculator will do the maths for you. News Australia TAS News VIC News QLD News SA News Education NSW News Finance.

Saturday 28 May 2022. Stay up to date with all of the breaking Tax headlines. The tax return deadline if youre lodging your tax return yourself is October 31 read our comparison on lodging yourself versus using a.

Key events for Australian shareholders 2012-13. Make sure your income details are correct. The latest Tax news events analysis and opinion from The Australian Financial Review.

Listing of individual tax return instructions by year. Taxpayers have begun to benefit from a 1080 government payment set to be given to more than 10 MILLON Australians this year. Then find out how you can slash your taxes.

Around 10 million Australians will pocket an extra 420 when they lodge their tax returns after July 1 under a plan to increase tax relief for low and middle income earners. Mercer Pacific president. 2 days agoExperts have revealed key tips on how you can get the most out of your tax return at the end of the financial year.

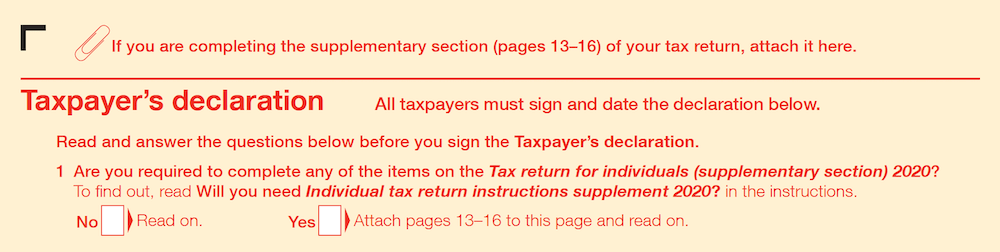

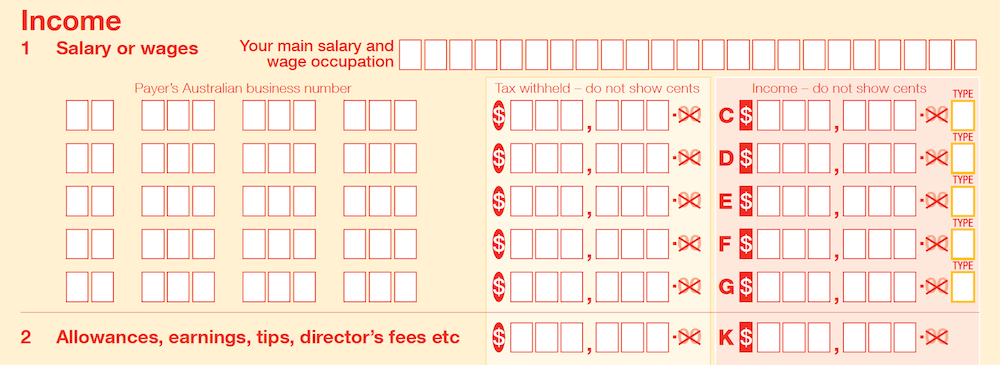

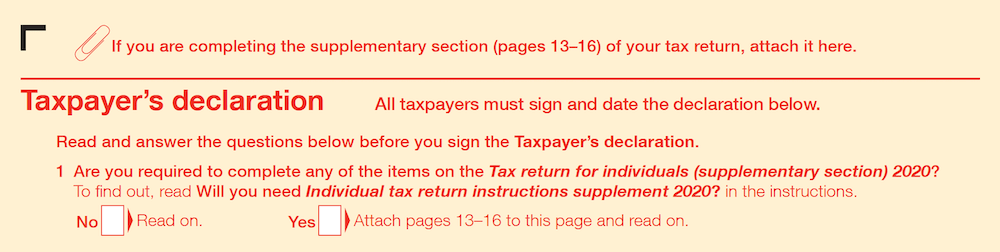

Tax return for individuals supplementary section 2012-13. Tax cuts worth 184 billion a disaster. A quick note on the tax cut itself.

Mark and Tara parents of three from Bendigo Victoria expected a 1000 refund when they lodged their 2020-21 tax returns but were instead handed a 2500 bill despite having tax withheld during. The superannuation system is inequitable and the federal government should consider raising taxes on wealthy savers a leading fund chief says. Payroll officer learns fate for lodging DOZENS of fake tax returns.

Australias high court finds the higher rate of tax for working holiday makers is discriminatory and breaches treaty with UK. The government handed down the 202021 Mid-Year Economic and Fiscal Outlook MYEFO on 16 December 2021 with several proposed changes to tax and superannuation laws. Under stage 3 tax cuts slated for July 2024 the 325 and 37 tax brackets are removed and replaced with a larger 30 tax bracket for anyone earning 45000 to 200000.

Federal budget 500pm. The 19 per cent marginal tax rate threshold was increased from 37000 a year to 45000 a year. You will get a Centrelink payment summary and will need to submit a tax return if you get or have received any of these taxable Centrelink payments in the 2021-22 financial year.

About 85 million Australians claimed nearly 194 billion in work-related expenses in their 2020 tax returns. We will review your tax return and check that you have received the maximum refund. Watch the video above for tips on how to get the most out of your tax.

Todays Tax news live updates all the latest breaking stories from 7NEWS. Australian TAX RETURN and TAX REFUND CALCULATOR. Some people get caught out theyll make the payment before June 30 but not realise it has not been processed in time says Elinor.

If you are a US. Australian residents who earn under 126000 annually are eligible to receive the Low and Middle Income Tax Offset LMITO which was passed by Parliament in June. Getting your return back as soon as possible is not the same as filing your tax as soon as possible.

Citizen living in Australia we will help you review your Tax. Instantly work out your estimated tax return refund. Find out if youll get a tax refund.

18 hours agoMay 30 2022 1221pm. Separation of new News Corporation from Twenty-First Century Fox Inc.

Income Tax News Research And Analysis The Conversation Page 1

Income Tax News Research And Analysis The Conversation Page 1

Income Tax News Research And Analysis The Conversation Page 1

Tax Returns In Australia Study In Australia

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

How Much Tax Do Aussies Pay Infographic Infographic Aussie Tax

What Are The Irs Penalties And Interest For Filing Taxes Late Cbs News

Income Tax News Research And Analysis The Conversation Page 1

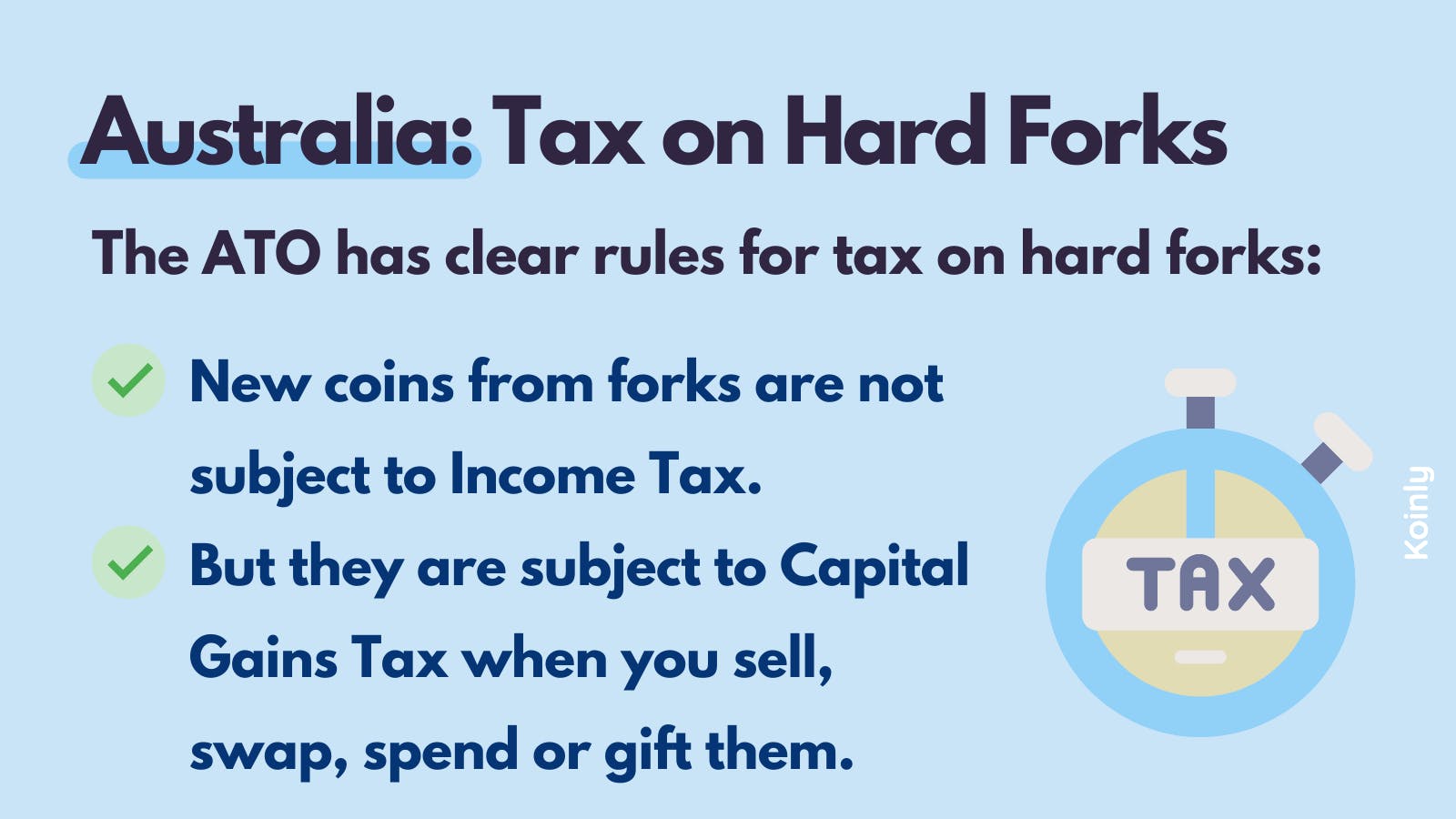

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Tax Returns In Australia Study In Australia

Tax Time 2021 Deadline For Diy Tax Returns Just Days Away As Fines Loom

Tax 2021 All The Dates You Need To Know To Avoid 1 110 Fine

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly